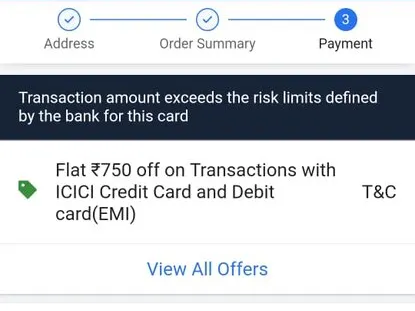

In the realm of electronic transactions, ensuring the security and protection of both merchants and consumers is paramount. One common hurdle that businesses and customers encounter is the message stating, “Transaction amount exceeds the risk limits defined by the bank for this card.” This occurrence may lead to frustration and confusion, but it ultimately serves as a safeguard implemented by banks to mitigate the risks associated with fraudulent activities.

In this article, we will explore the reasons behind this message, understand the importance of risk limits, and discuss potential solutions for businesses and customers facing this situation.

Understanding Bank Risk Limits

To safeguard against unauthorized transactions and potential financial losses, banks establish risk limits for each credit or debit card issued to customers.

These limits are determined based on various factors, including the customer’s transaction history, spending patterns, geographical location, and the individual’s creditworthiness. The primary objective of these risk limits is to prevent fraudulent transactions that could harm both the cardholder and the bank.

Fix: Transaction amount exceeds the risk limits defined by the bank for this card

1. Cardholder’s Spending Patterns

One common reason for exceeding transaction limits is when the purchase amount deviates significantly from the cardholder’s typical spending habits. This can trigger a risk assessment from the bank’s end, leading to the transaction being declined. To address this issue, cardholders can proactively inform their bank about any upcoming large purchases to ensure smoother transactions.

2. Increased Frequency of High-Value Transactions:

If a cardholder frequently makes high-value transactions within a short period, it might raise red flags for the bank’s risk monitoring systems. To mitigate this, customers can consider spacing out their purchases or contacting their bank to request a temporary increase in their transaction limit.

3. Geographical Constraints

Some banks have predefined risk limits for specific geographical regions due to higher instances of fraudulent activities in those areas. In such cases, customers may experience transaction declines when making purchases outside their usual location.

To avoid this, individuals can inform their bank about their travel plans in advance or consider using alternative payment methods like travel cards or digital wallets.

4. Technical Glitches or Communication Issues

Occasionally, transaction declines occur due to technical glitches or temporary communication issues between the merchant’s payment gateway and the bank’s authorization system. In such cases, the problem often resolves itself within a short period. Cardholders can retry the transaction later or contact their bank for further assistance.

5. Working with Banks to Resolve the Issue

If a transaction exceeds the risk limits defined by the bank for a specific card, it is crucial for both businesses and customers to cooperate and take appropriate steps to resolve the issue

Customers should contact their bank’s customer service helpline to gain insights into the reason behind the transaction decline. This will allow them to understand the specific risk limits associated with their card and explore potential solutions.

Businesses can offer customers alternative payment methods, such as bank transfers, installment plans, or digital wallets, to accommodate those facing issues with exceeding risk limits on their cards.

Regular customers facing repeated issues with transaction declines can work with their bank to review and potentially adjust their risk limits based on their legitimate spending patterns.

Conclusion

While encountering the message “Transaction amount exceeds the risk limits defined by the bank for this card” can be inconvenient, it is important to remember that this security measure exists to protect both cardholders and banks from fraudulent activities.

By understanding the underlying reasons and collaborating with financial institutions, customers and businesses can find practical solutions to ensure secure and hassle-free transactions. Emphasizing communication, exploring alternative payment options, and building trust with banks will help mitigate the issue and provide a smoother payment experience for all parties involved.